Impact of us recession on india stock market

Latest Indian Business News Financial World - Latest Articles Latest World News. The economic slowdown of the advanced countries which started around mid , as a result of sub-prime crisis in USA and within no time engulfed the whole world and has affected each and every individual across the globe. World over, companies are biting dust including lions of financial world like, Lehman Brothers, Bear Sterns, AIG, Merill Lynch etc.

Many banks are almost on the verge of collapse and frantic steps are undertaken by the respective governments to prop them up. The contagion has traversed from the financial to the real sector and the recession will be deeper and the recovery appears to be longer than earlier anticipated. A recession is a decline in a country's Gross Domestic Product GDP growth for two or more consecutive quarters of a year.

A recession normally takes place when consumers lose confidence in the growth of the economy and spend less. This leads to a decreased demand for goods and services, which in turn leads to a decrease in production, lay-offs and a sharp rise in unemployment.

Global Recession and Impact on Various Sectors of Indian Economy

Investors spend less as they fear stocks values will fall and thus stock markets fall on negative sentiment. Impact on Indian Economy: The impact of the crisis is deeper than estimated by our policy makers although it is less severe than in other emerging market economies. Further, the Indian banking system is one of the least affected in the whole world and has been praised by many of the economists and financial experts. The banks were saved from this downturn because of the financial policies which were very well formulated that acted as an insulator for the Indian banks.

The extent of impact has been restricted due to several reasons such as-. The credit derivatives market is in nascent stage and there are restrictions on investments by residents in such products issued abroad. Despite these mitigating factors, India too has to weather the negative impact of the crisis due to rising two-way trade in goods and services and financial integration with the rest of the world. Indian economy is experiencing the following incidental effects of the Global Crisis.

Slowing Gross Domestic Product: In the past 5 years, the economy has grown at an average rate of per cent. Services which contribute more than half of GDP have grown fastest along with manufacturing which has also done well. But this impressive run of GDP ended in the first quarter of and is gradually reduced and now it is projected at 6 per cent for Hence, the slowdown in Indian economy is evident from the low GDP growth with deceleration in the industrial activity, particularly in the manufacturing and infrastructure sectors and moderation in the services sector mainly in the construction, transport and communication, trade, hotels and restaurants.

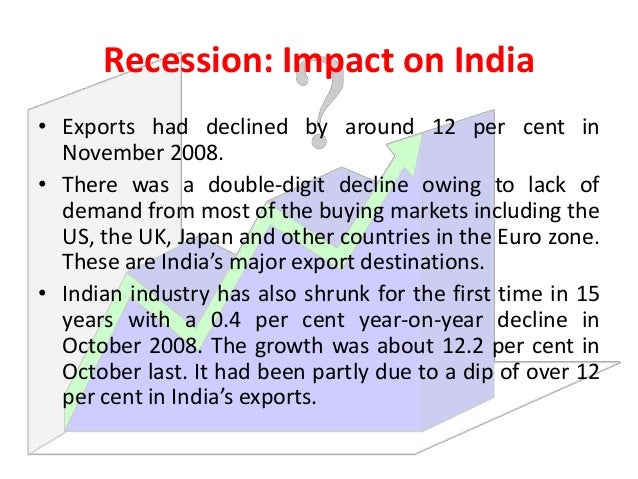

The recession is likely to have a dual impact on the outsourcing industry. The tax-GDP ratio registered a steady increase from 8. But this trend has been reversed as the tax-GDP ratio has fallen to The growth in exports was robust till August , however, export growth evinced a sharp dip and remained negative till the end of the financial year on account of major outsourcing deals with US companies, which were effected in the crisis.

The current economic crisis was largely insulated by the reversal of foreign institutional investment FII , external commercial borrowings ECB and trade credit. Its spillovers became visible in September-October with overseas investors pulling out a record USD However, now it is recovered and hovering around Rs. The money market consists of credit market, debt market and government securities market. All these markets are in some or other way related to the soundness of banking system as they are regulated by the Reserve Bank of India.

Indian stock market crashed from the high of to a low of around points during the year Corporate performance of most of the companies remained subdued, and the impact of moderation in demand was visible in the substantial deceleration during the said years.

Corporate profitability also exhibited negative growth, which has led to the bearish trend in the stock market. Recession has effected the investments made by Foreign Institutional Investors FIIs in the Indian Stock Market as FIIs started disinvesting to meet their commitments abroad.

This is putting lot of pressure on domestic financial system, which has led to liquidity crunch in all major sectors of the country. The worst hit industry in India and abroad is Realty Sector. It is a time to introspect for everybody.

There have been things to learn, relearn and unlearn for all the concerned viz. End Users are more cautious and looking for value for their investment and Lenders are exercising prudence while selecting the borrowers. Developers have started focusing attention on affordable and mass housing with attracting plans. More cautious spending and greater saving by consumers, more prudence by lenders, shift in focus from premium to lower and mid-end segment of housing by developers, is exactly what our economy needed for its long-term health and recession is having the desired impact.

The End User is going to be benefited as the supply chain started addressing the real demand in market - affordable housing.

The consumption of basic requirements such as Food, Shelter, Clothing, Water, Electricity and Health etc. Hence the providers of the basic needs are required to focus their attention to offer them at affordable cost. India has over million cell phone subscribers, which is next to China. India's Internet infrastructure is a revolution.

What is Economic Recession? Its Impact on Indian Economy?

India has over 70 million internet users and expected to increase to million in the next 5 years. This means that even the individuals from India's remotest regions can now showcase and offer their businesses to customers based anywhere globally.

Now they realized the importance of savings and financial discipline, which definitely paves the way for better future. Thus, the present crisis definitely will be an enabling factor to come up with innovative ways to handle the problems for survival, which is need of the hour. Deposits NRI Mutual Funds Insurance Press Releases Hot Talks Latest Articles Disclaimer Wage Revision Book Store.