Long dated out of the money call options

I swing trade equity options every once in a while for fun. This morning I witnessed something I do not understand at all.

I Dated Monica Lewinsky

In the attached photo, why would someone purchase 6 contracts for. I just can't wrap my head around this! It happened again the next day with 74, see new table with headers as per request: My only reason for asking is because RY. TSX is the Royal Bank of Canada, this stock will not move multiple dollars in 3 days expiry in this scenario. Why buy 10 74 for. If you do the math excluding commissions: For the skeptics another screen shot to actually confirm this order: I suggest you look at many stocks' price history, especially around earnings announcements.

It's certainly a gamble. If you look at the current price, the strike price, and the return that you'd get for just exceeding the strike by one dollar, you'll find in some cases a 20 to 1 return. A real gambler would research and find companies that have had many earnings surprises in the past and isolate the options that make the most sense that are due to expire just a few days after the earnings announcement. I don't recommend that anyone actually do this, just suggesting that I understand the strategy.

Edit - Apple announced earnings. What you see there with the bid and ask is the CURRENT bid and CURRENT ask. The high ask price means there is no current liquidity, as someone is quoting a very high ask price just in case someone really wants to trade that price.

But as you said, no one would buy this with a better price on a closer strike price. The volume likely occurred at a different price than listed on the current ask. This person could also gain, by the implied underlying volatility of the stock rising if it moves erratically to either side.

It doesn't have to be a super complex trade with a bunch of buys or sells. In fact, I bought a far out of the money option this morning in YHOO as a part of a simple vertical spread. Perhaps it was to close a short position.

Selling Deep out of the Money Options to “Drive Up” your Odds of Success | wixequj.web.fc2.com

Suppose the seller had written the calls at some time in the past and maybe made a buck or two off of them. By buying the calls now they can close out the position and go away on vacation, or at least have one less thing they have to pay attention to. If they were covered calls, perhaps the buyer wants to sell the underlying and in order to do so has to get out of the calls.

Buyer had previously sold a covered call. By posting your answer, you agree to the privacy policy and terms of service. By subscribing, you agree to the privacy policy and terms of service. Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered.

Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top. Why would someone buy a way out-of-the-money call option that's expiring soon?

Can we see the heading for this table? Are you sure you're reading this right? GuySirton Pictures added, I guess maybe the last scenario I'm missing is a possible super complex strategy with a bunch of buys and sells?

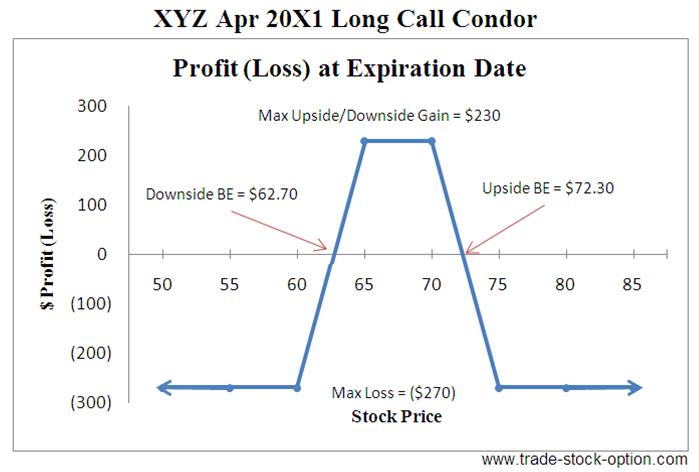

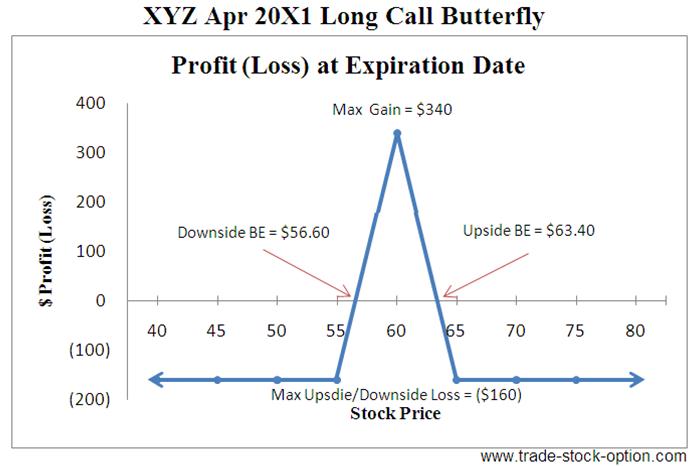

In the Money Options - A Stock Traders Secret WeaponBut in your second set of data it's 0. Still a bit odd, could be some sort of hedging strategy. Could be someone who doesn't know what they're doing Valid reasons to waste money on such worthless strikes could include a bear call spread, possibly a long condor or butterfly type trade.

Rolling Weekly Options & Covered Call Writing | The Blue Collar Investor

I did not know when earnings announcement would be. I was attempting to answer the question in a general way to explain why such a transaction might occur. For this particular stock I admit I have no idea why this transaction would make any sense.

Perhaps inside information that something is going to happen? I'm inclined to say typo Thanks for the input, much appreciated!

Although you would want puts. Mar 18 '14 at Thanks for the simple yet totally plausible scenario description! Out of the money options often have the biggest changes in value, when the stock moves upward.

Still seems to be a very risky game, given only 4 days to expiry. The most likely explanation is that the calls are being bought as a part of a spread trade. Like you said, it wouldn't make sense and wouldn't be worth it to buy that option by itself.

I think the best answer that doesn't make the buyer look like a moron is this. Sign up or log in StackExchange. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name. In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers.

MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.