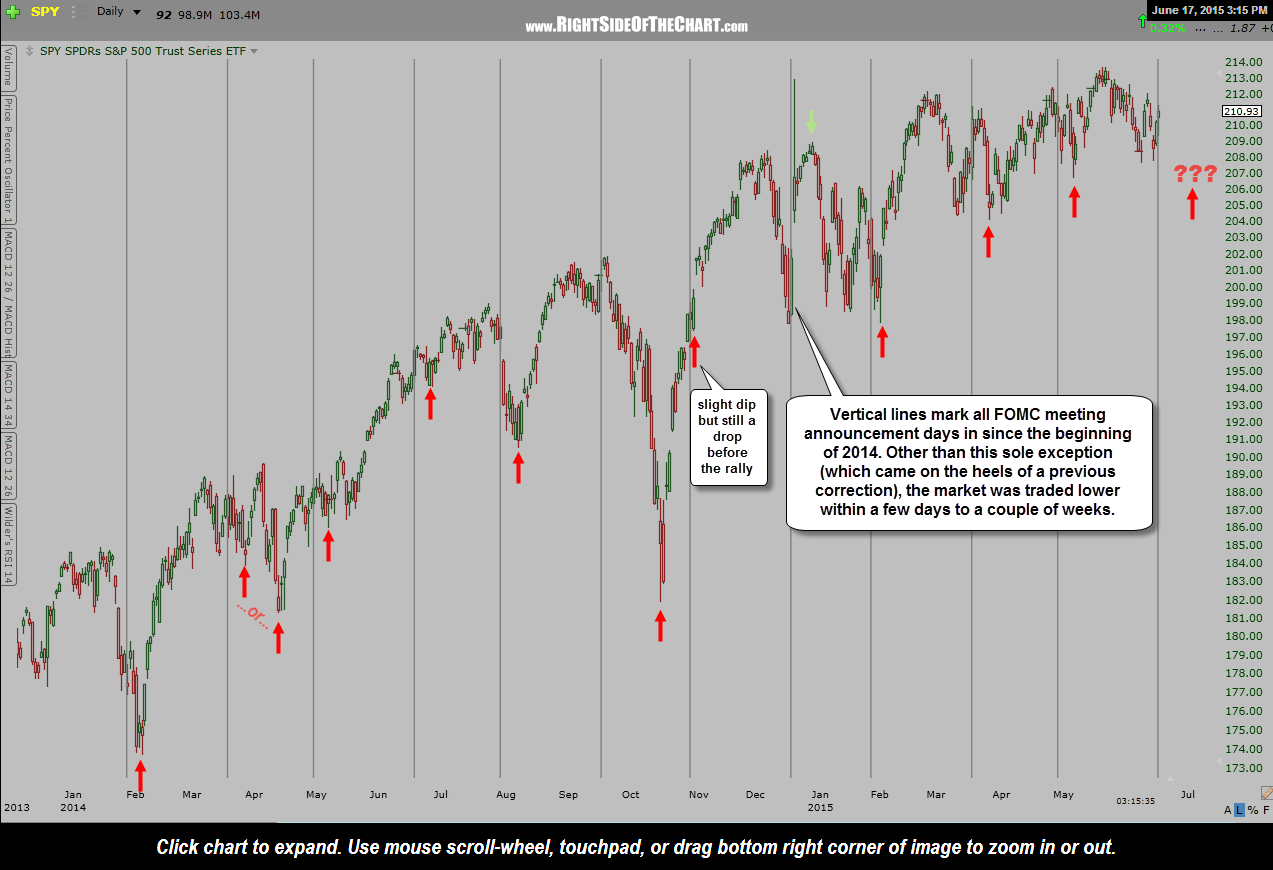

Stock market reaction to fed announcement

BROWSER UPDATE To gain access to the full experience, please upgrade your browser: Chrome Safari Firefox Internet Explorer.

If you are running Internet Explorer 10 and above, make sure it is not in compatibility mode. The Federal Reserve wraps up a two-day meeting Wednesday with new economic forecasts, a policy statement and a quarterly press conference from Fed Chairwoman Janet Yellen.

Asked whether the policy actions could overlap, Ms. Yellen said, "I would say we have made no decision on that. And it really hinges on the outlook and our assessment of conditions. Several bond dealers said in a May Fed survey they had already moved forward their forecasts for balance-sheet action into from , and most banks now target the fourth quarter for when the Fed will pull the trigger.

But with one more rate increase penciled in by the Fed this year, some are divided over whether the Fed will lift rates in September and then make balance-sheet changes in December, the reverse of that sequencing, or do both at the same time.

Before the June Fed meeting, economists at Deutsche Bank AG, Goldman Sachs Group Inc, Morgan Stanley and RBC Capital Markets all expected the Fed to announce plans to run off its portfolio in September and implement those plans in October, before hiking rates in December. The overall market didn't get any big surprises out of the Fed, but the energy market did get a surprise out of the latest supply data, further dashing hopes that the glut of oil on the global market is disappearing.

The latest reports on retail sales and inflation both showed an economy that remains stuck in its meager growth channel. Indeed, the Fed's own projections for growth over the next three years pointed to an economy featuring full employment and tepid growth.

In the morning, the yield on the U. The yield finished the trading day at 2. So much for another "taper tantrum. Two-year Treasury yields rose 0.

The mortgage-bond market is "responding hardly at all," wrote Walter Schmidt, senior vice president at Mortgage Strategies, in a client note. In her press conference, Ms. Yellen said the caps on roll-offs "should guard against outsize moves in interest rates and other potential market strains. Yellen told reporters she is open to looking at ways to reduce regulatory burden surrounding the Volcker Rule, as recommended by a report from the Treasury Department released Monday.

Yellen noted the Fed has already suggested exempting small banks from the rule, as Treasury also did. But she said she was pleased to see the report--required by an executive order from President Donald Trump--endorsed a restriction on proprietary trading. Yellen added that she supports simplifying capital requirements for community banks, as suggested by the Treasury. Yellen's press conference has now ended. If you were wondering who was asking all those questions, here's the list of people who had the microphone at today's conference.

As the Fed prepares to start shrinking its balance sheet, what has it learned about the role of asset purchases as a monetary policy tool? Yellen said the Fed and outside economists have studied this question extensively. In the future, she said, rate cuts will be the Fed's primary tool to stimulate the economy, but forward guidance and balance-sheet policies remain in the tool kit.

She declined to say whether the Fed would consider raising rates at the same meeting in which they start shrinking the balance sheet.

The Fed has made no decisions about that yet, she said. Yellen, without bringing Mr. Trump into it, simply said she has believed it was appropriate for rates to be low for a long time to support the economy.

Inflation is cooling again, and the Federal Reserve hopes that is only temporary. The Fed today unveiled a plan to shrink the balance sheet but didn't actually begin to implement it. Yellen said the reason for this move is that so, when the Fed does start the plan, "nobody is taken by surprise.

Yellen said that her colleague Patrick Harker, the Philadelphia Fed President, joked that the process should be like "watching paint dry.

This is an important issue facing the Fed, Ms. Yellen said, and a decision will have to be made at some point in the future. She acknowledged, though, that economists have learned more since then. There may be both costs and benefits to a higher inflation target, she said, that must be balanced.

With today's interest rate, she said, "All that we're doing in raising rates is removing a bit of accommodation, heading toward a neutral pace. Many people describe the Fed's move to raise interest rates as exactly such a brake on continued improvement.

To continue the automotive metaphor, Ms. Yellen seems to believe the Fed is easing its foot off the gas pedal, but not pressing on the brake. This is a key to understanding why it's no surprise that the Fed is raising rates even with inflation below its target. Financial conditions have actually loosened since the Fed started to raise rates in late Is the market not listening to the U.

Yellen noted the stock market is up and dollar has come down a bit recently, and "we take those factors into account. Yellen was asked if there's a risk to the economy if the big changes that many are expecting from Congress never actually materialize.

Policy changes such as major tax cuts, overhauling the health care system, and a major infrastructure spending bill are still unsure. Yellen said she doesn't see much risk of a pullback because, despite some higher expectations, most businesses haven't changed their plans that significantly.

She said it's important to not overreact to often-noisy data. The Fed has taken note of the recent string of weak inflation readings and is monitoring the situation, but continues to think that with a strong and still-strengthening labor market, "the conditions are in place for inflation to move up," Ms. She acknowledged uncertainty about the precise dynamics involved, but also reiterated her belief in the Phillips curve. The Fed's decision to raise rates didn't surprise Brett Ewing, chief market strategist at Tallahassee, Fla.

Business News, Personal Finance and Money News - ABC News

Even as some economic data, including inflation and retail sales, has been soft, he said he likes this market environment because volatility has remained near historic lows.

He said he still likes stocks, though, particularly U. The Federal Reserve's policy-makers are sticking to their guns. Yellen was asked about her conversations with President Donald Trump and whether she would like to be reappointed to a second term as Federal Reserve chairwoman. I have not had conversations with the president about future plans and I do very much hope, I know they have been working hard to identify appropriate nominees for the open slots, and I do very much hope there will be nominations in the not-too-distant future and the Senate will take that up expeditiously.

Pressed if she desired to remain at the Fed, she responded only: This was her opportunity to talk about her future and she was certainly prepared for questions about this. It's unlikely that Ms. Yellen will make any further news about her future at the Fed at today's press conference.

That phrase is important because the Fed said today that it will start to reduce the size of its balance sheet "once normalization of the level of the federal funds rate is well under way. There's "no specific level" of rates that means that condition has been met, Ms.

Yellen said, and it also depends on other factors such as the Fed's confidence in the outlook. Although the Fed hasn't decided exactly how far it will shrink its balance sheet, Ms. One debate that will probably take years to unfold is what exactly that level will be. Yellen's opening remarks emphasized the difference in strategy between how the Fed is thinking of future interest rate increases and in its plans to shrink its balance sheet. The Fed's new balance sheet unwinding strategy, when it begins, will be "a gradual and largely predictable decline.

Yellen today repeated the Fed's line that interest-rate increases are "not on a preset course" and the Fed has repeatedly said that the timing of interest rate moves are "data dependent" and thus, not as predictable. DOW JONES, A NEWS CORP COMPANY. News Corp is a network of leading companies in the worlds of diversified media, news, education, and information services. Subscribe Now Sign In. The Wall Street Journal. Regions Africa Asia Canada China Europe Latin America Middle East Blogs Brussels Real Time China Real Time Sections Economy More World Video.

Video What's News Podcast. Blogs Real Time Economics More Economic Forecasting Survey Economy Video. Columnists James Freeman William A. Galston Daniel Henninger Holman W. Jenkins William McGurn Peggy Noonan Mary Anastasia O'Grady Jason Riley Kimberley A.

Reviews Books Film Television Theater Art Masterpiece Series More Arts Video WSJ. Magazine WSJ Puzzles Off Duty Podcast The Future of Everything. Sections Commercial Real Estate House of the Day Mansion More Real Estate Video. Chrome Safari Firefox Internet Explorer Note: Federal Reserve Interest-Rate Decision—Live Analysis Last Updated Jun 14, at 4: Open To Easing Volcker Rule Burdens. Fed Raises Rates, Sets Out Plan to Shrink Asset Holdings Beginning This Year.

Fed Still Eyes One More Rate Increase. That May Be as Good as It Gets. A Requiem for Bond Buying: A Look Back at How the Fed Supersized Its Balance Sheet.

Yellen took a lot of questions about low inflation, but she's dismissive of these concerns. The recent bout of soft numbers including today's are fluky, in her view, and not something that's about to disrupt the course of monetary policy. The Fed is going to continue to tinker with the exact timing of interest-rate increases, but officials' strategy for the balance sheet is going to be a lot different.

They want a quiet, low-drama process, not a big theatrical debate like they've sometimes had over balance sheet policy in the past. Speaking of no drama, Ms. Yellen carefully preserved the "uneasy peace" between the Federal Reserve and the White House. Despite the fact that her future at the Fed is in question, she gave no indication of her thinking about personnel changes at the Fed.

This is the third straight press conference where Ms. Yellen has announced a rate increase. For years, there were questions about whether the Fed would have the guts to raise rates, and about the potential for it to be a really difficult process.

"This Is Not The Reaction The Fed Wanted": Goldman Warns Yellen Has Lost Control Of The Market | Zero Hedge

It indeed got off to a slow start. If the economy continues to move along at this gradual pace, it's quite likely the Fed will remain comfortable with further gradual increases.

Analysis , Highlights , Video. The Fed Moves One Way, Inflation Another. Yellen emphasized a view that many commentators disagree with. See Markets React to the Fed in 7 Charts. Yellen does not sound worried about the recent weakness in U. Is the normalization process "well under way? Dow Jones Products Barron's BigCharts DJX Dow Jones Newswires Factiva Financial News Mansion Global MarketWatch Private Markets realtor.