American call option early exercise

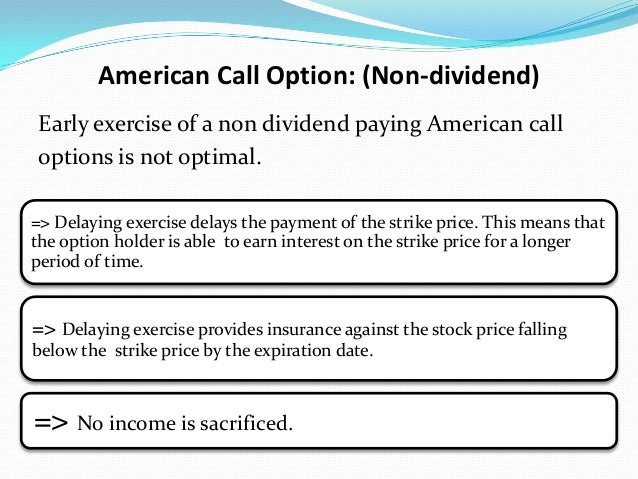

Early exercising American call option on a non dividend paying stock is not optimal for two reasons. One delaying exercise delays the payement of the strike price. This means that the option holder is able to earn interest on the strike price for a longer period of time. Second assume that you exercised your option today, what if tomorrow a big crazy thing will occur and the price of an underlying asset just shoots?

Error (Forbidden)

Sorry baby you already exercised your option and you sold your right to buy at a very cheap price. Instead of exercising your American call option you should have sold it to someone else.

Subscribe to comments with RSS. This is not entirely correct. What do you do? All the theory in books is concerned with Risk Neutral World, which is like believing in Santa Claus. As a speculator if you know tomorrow stock might follow u do exercise.

Thank you very much for your feedback Quantanalysis. I will try to convince you why you should never exercise your American call option early.

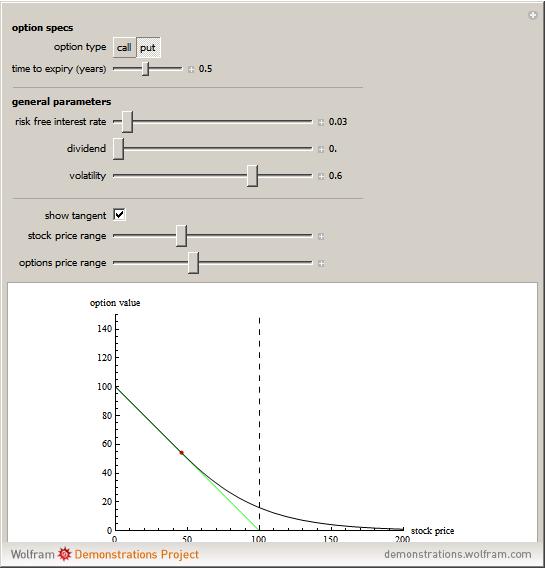

When you buy option, call or put, you buy the volatility.

Exercise (options) - Wikipedia

Thus you should be interested in the direction of volatility instead of price. Second the beauty behind the Black-Scholes is the ability to set-up a risk-free portfolio, which allows you to speculate either direction, the value of your portfolio at a future time can be discounted by a risk free rate.

The option price you see is calculated through this Risk Neutral World rate. The answer to the question, why you should never early exercise call option goes like this.

Suppose today you are considering exercising early an in-the-money American call option. If american call option early exercise exercise does usaa trade otc stocks pay the Strike price and receive an asset worth of Spot.

You should already know that the the American call must be worth no less than the European call, it therefore must also be worth at least Spot — American call option early exercise discounted. Thus there is no reason to exercise the call early.

Considerations for Exercising Call Options Prior to Expiration | IB Knowledge Base

I understand this theory. My point is a bit different. All the hedging theory works in complete markets and this includes optimal exercise time for American option.

Sky News - LiveConsider a very crude example, I buy an option from Goldman Sachs as their client. Would you exercise it to get out of this position? What do you do in this case? If you can replicate everything why actually buy derivatives……. Since you can replicate…. Answer to second comment is, if you replicate the portfolio through many assets, why should you pay commission twice, when you can hold the derivative itself.

People buy the stock and the putbut actually replicate a portfolio with a call and fixed income security. Then just hold the call option. If you have a better reasoning, please share.

It's NEVER logical to exercise an American call option early (non-dividend stock)? - Actuarial Outpost

Replicating a portfolio with derivative is different. In theory they suggest replicating a derivative with Stock and Bond.

Whenever the assumption of risk neutrality comes it becomes theoretical rather than practical. You are commenting using your WordPress. You are commenting using your Twitter account.

You are commenting using your Facebook account. Notify me of new comments via email. Posted in Uncategorized by qmarks on November 22, Quants Trader said, on May 1, at 7: Quants Trader said, on May 1, at 4: Quants Trader said, on May 1, at 5: Quants Trader said, on May 1, at 6: Leave a Reply Cancel reply Enter your comment here Please log in using one of these methods to post your comment: Email required Address never made public. About Author Disclaimer Search for: